Who wouldn’t love a one-time investment that keeps pouring in money for a lifetime? This is what passive investing promises – but only when done right.

It’s true that the bulk of investments require a more hands-on approach, involving a higher frequency of buying and selling.

However, for passive investing, the investor adopts a more long-term approach, where he holds a broad spectrum of differing assets based on the belief that their value will ultimately go up and earn him a profit.

So, if you are not a fan of frantically monitoring trading charts and market movement, you could go with passive investing, so you can invest without needing to frequently adjust or supervise your holding.

Sound interesting? Read on for more details!

Who Is Passive Investing Right For?

Admittedly, passive trading isn’t for everyone. Passive investing requires a great deal of tolerance toward market volatility – arguably, not all of us can boast this attribute.

You must also have the discipline to let your investment consolidate and appreciate with minimal intervention. This will not happen in a week – perhaps not even in a year – but ultimately, the longer you wait, the bigger your payoff is likely to be.

This “buy and hold” passive investment strategy is worlds apart from active investing. In the latter, the portfolio manager is constantly monitoring his assets, watching out for daily market movers, and identifying the best opportunities to sell or buy.

So, let’s look at some advantages of passive investing and also the concerns regarding this trading strategy.

Benefits of Passive Investing

Low Asset Supervision

This trading model requires minimum monitoring and intervention. If you were an active investor – let me say a day forex trader – you would be observing your currency charts all through the day while watching out for critical market news.

Well, I don’t need to tell you this is exhausting. But if you were a passive investor, it is as good as dumping your investments and allowing them to compound almost autonomously.

Most investors are fanatic about passive investing because they don’t need to babysit their portfolio.

Less risk exposure

More than that, passive investing comes with a reduced risk coefficient compared to active investing. Passive investing requires a lesser volume of selling and buying. Therefore, there are fewer chances of making the mistake of buying too early or selling too late.

The passive investor makes do with steady market growth, eventually exiting the market once (after a long time) rather than a sporadic exit and re-entry as typifies active investing.

Passive investors pay lesser fees

If you think constant monitoring of assets was the only pain of active investing, sorry, you would have to think again. Active investing takes more transaction fees.

But passive investors pay far less. For example, if you were to invest in index funds, you wouldn’t pay more than 0.10% in transaction fees. Compared to active investing, investment managers charge passive investors less.

Cons of passive investing

Wait, passive investing isn’t the Holy Grail of investing – actually, there isn’t any. As typical of any genuine investment, passive investing has its downsides too. Let me tell you.

Lesser returns

Not all investors find potential rewards from passive investing attractive. This is not unconnected from the fact that passive investors don’t beat the market.

It is the active investor who is relentlessly exploring opportunities to outsmart the market that can make enormous returns – albeit it being very risky. As a passive investor, you usually take home modest gains corresponding to how the market performed.

No short way out

There are few leeways for passive investors other than riding out the market. This is not an investment that you could quickly sell out in case of emergencies or to afford your next lunch pizza.

If you attempt to bail out too soon in passive investing, you may have to sell your assets at a loss. In passive investing, your investments are not buffered from short-term drops either.

Nevertheless, with the right passive strategy, you can suppress the negatives and amplify profitability. What passive strategies give you the best prospect of making a fortune?

5 Topnotch Passive Investment Strategies

1. Peer-to-Peer (P2P) Lending

Peer to peer lending is a fast-growing industry. A nascent industry born just over a decade ago, the P2P lending market grew to $67.93 billion in 2019. More interestingly, projections anticipate the P2P lending market growing to $558.91 billion by 2027.

In P2P lending, a cluster of lenders pool together loans that are disbursed to a business or an individual. This is otherwise known as crowdlending.

In this passive investing model, you (and the other lenders) assume a bank’s position, at which point the loans you disburse attracts interest rates.

An academic research report from the University of California, Berkeley found interest rates on peer to peer lending loans to “have remained durable throughout economic cycles, and can provide a significant boost to portfolio income”.

Depending on the platform and the loan terms, annual returns on P2P loans generally range from 7-12%. The pricing of P2P loans is done on credit grades. These grades are determined based on the loan amount and term, borrower’s debt-to-income ratio, credit score, and loan purpose.

Indeed, this gives you more control over your investment. A portfolio built from appropriately balanced credit grades can earn you returns running into double digits.

When you take off the conventional 1% management fee and also allowance for possible default, you are yet left with a sizable sum. Would you say that was bad for doing almost nothing?

Also, just anyone can invest in the P2P lending market. Contrary to other investments where enormous entry capital is needed, a lender doesn’t have to finance the whole loan (a collaborative trait of a mutual fund). Rather he buys notes. These notes can be as little as $25.

You agree this reduces your risk exposure. Instead of basing all your funds into one loan with the possibility of such investment being wiped out upon a single loan default, you can slice up your fund and scatter it across several loans.

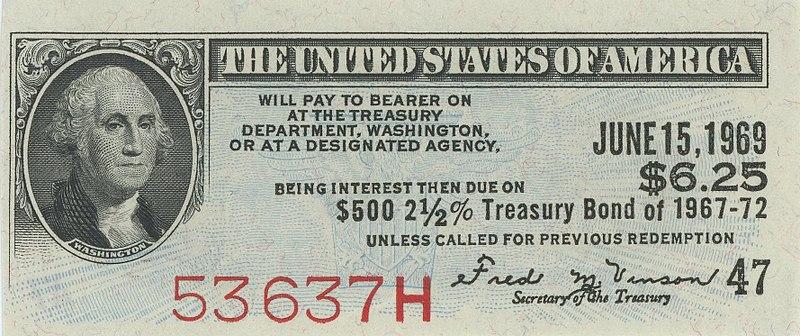

2. Investing in bonds

When you buy a bond, what you are doing is lending fund back to the bond issuer. This implies bonds are debt securities where the issuer owes the holder a specified amount as determined by the bond’s terms.

The issuer must pay the holder interest on this debt at a predetermined interval (whether annually, semiannually, or even monthly), and when the bond matures at a specified date, the investor is reimbursed with the capital.

Bonds are excellent passive investing avenues to diversify your investment portfolio. When you invest in highly-rated bonds, you are banking on entities with consolidated financial health to pay back the debt you are issuing them as arranged in the indenture or formal debt agreement.

Bonds stand out for their volatility. Compared to what is obtainable in the stock market, medium and short-dated bonds are safer investment outlets. More than this, holders of bonds are assured of sustainable cash inflow.

This is a massive plus as even at periods where rates are particularly down, you can resort to either emerging market debts or high-yield bonds. This ensures you can build a portfolio that consistently assuages your income needs.

When your bond portfolio is appropriately diversified, you can enjoy reduced volatility (compared to equities) enhanced with impressive yields.

The liquidity of bonds is another reason why they are a worthy passive investing outlet. Large amounts of bonds can be sold off without any reasonable impact on prices. Believe me, you are rarely getting this on the stock market.

There are also various bonds to choose from. From convertible bonds to floating rate bonds to fixed rated bonds, you are getting spoiled for choice.

3. Private Equity Investing

As inferable from the name, private equities are investments sourced externally of public markets. This is typical of an investor buying into a company, anticipating a period of accelerated growth.

In private equity investing, the investor buys securities with a view of selling later, accruing higher returns and diversifying his portfolio in the process. Private equity firms are the most prevalent sources of private equity investments.

Here, the private equity manager is tasked with identifying the company with the highest prospects to invest raised capital in.

Compared to how public equities have been performing across the last two decades (in the American and European markets), private equities have had the upper hand regarding long-term returns. Interestingly, the private equity market has been growing by an average 20% annually since 2000.

There are many subcategories of investments housed under passive investing. This includes distressed funding, leveraged buyouts, growth capital, and venture capital funding.

4. Investing in Index Funds

Come on, there isn’t any way we would talk about passive investing without mentioning index investing. Index fund is simply mutual fund that track how well the underlying index is performing.

Commonly, this index consists of bonds and stocks. Provided the index’s makeup isn’t altered, the underlying securities aren’t altered either. Typically, a brokerage or a mutual fund company sells you index funds.

Index funds are famed passive investing avenues given their simplicity in management (coping well with a hands-off approach), lower management fees, and diversification.

Your job is to pick the right index to track. The Standard & Poor’s 500 (S&P 500) index counts as one of the most reliable indexes and is massively adopted in the United States. Aside from the S&P 500 index, there are other notable ones like the Russell 2000 and Bloomberg Barclays Global Aggregate Bond.

After choosing your preferred index, the next step would be identifying the befitting index fund to track the performance. The next step is buying index fund shares with a broker. Indeed, going with a brokerage could be the perfect option when you desire to unify all your investments under one account.

5. Investing in physical real estate

You don’t need a genius Elon Musk IQ to grasp physical real estate investing. It is easy, tangible, profitable, and, more importantly, resilient.

Unlike in the stock market where you can wake up a millionaire and sleep a pauper, physical real estate gives you a more sustainable store of value with a significant chance of appreciation.

Isn’t it exciting that the American housing market is worth $33.6 trillion? Here is something to tickle your fancy more: the cost of renting has risen by 66%.

Therefore as a real estate investor, you can be assured of a steady – and even progressive – cash flow from your real estate investment with little or no work.

If you do your homework properly when investing in real estate properties, you should be anticipating at least a yearly cash flow of 6%.

Real estate investing gives you equity buildup. The bulk of real estate investors buy properties with a comfortable down payment. The larger slice of the cost of the property can be offset with debt financing from a suitable lender.

Aside from the closing phase of the amortization period where the mortgage is paid quickly, the principal is paid slower at the start. With the principal spread over time and consequently more convenient to settle, it is easier to accumulate equity.

Of course, you could have maintenance responsibilities on your shoulders if you go for rental property. But so long you are diligent in selecting your tenants, there is a solid chance of having responsible and sufficient tenants who wouldn’t call your phone dead with complaints.

Besides investing in residential rentals, self-storage is another niche worth investing in commercial real estate. Take this from me, this niche is booming.

You can tell I am not mincing words as the American self-storage industry pools over $22 billion in yearly revenue. What more, 10% of American families leverage at least one of the over 50,000 self-storage facilities spread across the US mainland.

This passive investing niche promises more than a stable cash flow. You also get fewer management chores on your table.

Would that be all the juice regarding self-storage? No!

Self-storage investing is more resilient to recession. Within the 2007-2009 span of the Great Recession, the self-storage industry averaged a recession of -3.80%. Whereas other sectors like retail suffered -12.32%, industrial -18.31%, and even S&P 500: -22.03%.

Conclusion

There you are! These are five of the most thriving passive strategies for you to make a substantial income doing little to no work.

At Self Storage Investing, we are committed to consolidating your financial dependence without bothering you with the infamous headaches associated with real estate investing like rents and toilets.

Now, you’re almost ready to invest the right way to generate consistent passive income. Submit your Application to be an Investor with us, and get started today.

Які МФО або ломбарди готові кредитувати простих українців і видавати їм кредит онлайн на картку без відмови і перевірок в інтернеті.

Миттєвий кредит за 1 годину на картку оформляється на офіційному сайті організації, що кредитує. Також можливе оформлення в офісі.

В Україні видають онлайн мікропозики на картку тільки після перевірки кредитної історії. Якщо вона погана, можуть просто відмовити і все.